/tice-news-prod/media/media_files/3uXv7LLIHJzIZ4kbvT7d.png)

In the 75th year of India’s Independence, the World has recognized the Indian Economy as a ‘bright star’ as the Economic Growth is estimated at 7 per cent, which is the highest among all major economies, in spite of the massive global slowdown caused by COVID-19 and Russia-Ukraine War.

Finance minister Nirmala Sitharaman said this while presenting the Union Budget 2023-24 in Parliament today.

Exuding confidence, she emphasised that the Indian economy is on the right track, and despite challenges, heading towards a bright future.

KEY HIGHLIGHTS OF THE UNION BUDGET 2023-24

- Union Budget 2023-24 Presents Vision For Amrit Kaal-Blue Print For An Empowerd And Inclusive Economy

- Three-Pronged Focus Driven By Four Transformative Opportunities Constitute Foundation Of Amrit Kaal

- Capital Investment Outlay Increased By 33% To Rs. 10 Lakh Crore

- Effective Capital Expenditure At 4.5% Of Gdp

- Fiscal Deficit Estimated To Be 5.9 % Of Gdp In Be 2023-24

- Real Gdp To Grow At 7% In Fy2022-23

- Exports To Grow At 12.5% In Fy 2023

- Atmanirbhar Clean Plant Program With Outlay Of ₹2200 Crore To Be Launched To Boost Availability Of Quality Planting Material For High Value Horticultural Crops

- 157 New Nursing Colleges To Be Established

- Outlay For Pm Awas Yojana Enhanced By 66% To Over Rs. 79,000 Crore

- Highest Ever Capital Outlay Of Rs. 2.40 Lakh Crore Provided For Railways

- Urban Infrastructure Development Fund (Uidf) To Be Established Through Use Of Priority Sector Lending Shortfall

- 500 New ‘Waste To Wealth’ Plants Under Gobardhan Scheme To Be Established At Total Investment Of Rs 10,000 Crore

- 10,000 Bio-Input Resource Centres To Be Set-Up, Creating National-Level Distributed Micro-Fertilizer And Pesticide Manufacturing Network

- Mantri Kaushal Vikas Yojana 4.0 To Be Launched

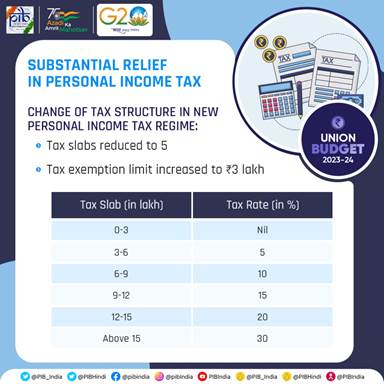

- Union Budget 2023-24 Provides Substantial Relief For Personal Income Tax

- New Slabs Announced Under The New Tax Regime

- Resident Individual With Total Income Upto ₹ 7 Lakh Will Not Have To Pay Any Income Tax Under New Tax Regime

- Standard Deduction Of ₹ 50,000 Will Also Be Available To Salaried Individuals Under The New Tax Regime

- New Tax Regime For Individual And Huf Will Be The Default Regime

- Limit For Tax Exemption On Leave Encashment On Retirement Of Non-Government Salaried Employees Increased To ₹ 25 Lakh

- Slew Of Proposals Announced For The Cooperative Sector

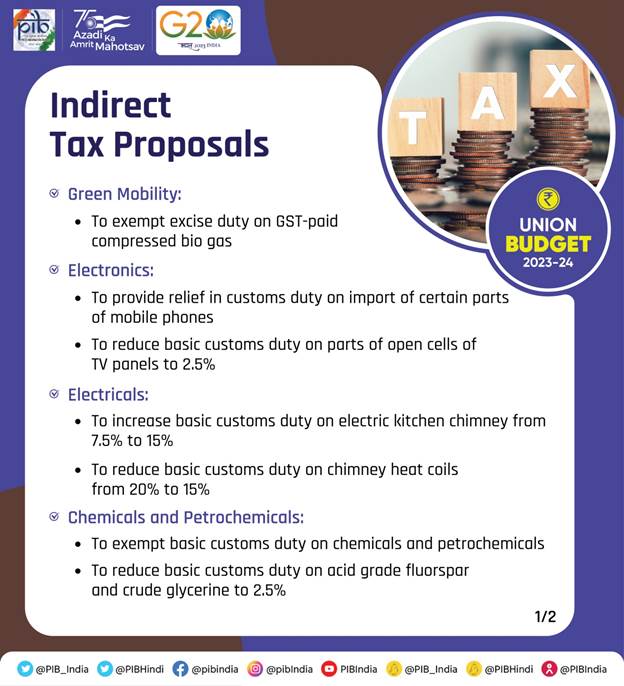

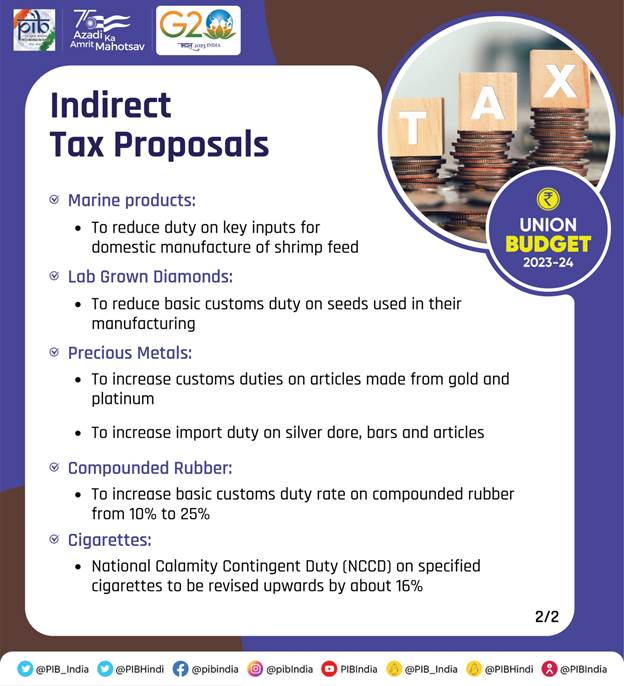

- Indirect Tax Proposals Aim To Promote Exports, Boost Domestic Manufacturing, Enhance Domestic Value Addition, Encourage Green Energy And Mobility

- Number Of Basic Customs Duty Rates On Goods, Other Than Textiles And Agriculture, Reduced From 21 To 13

Resilience amidst crises

The Finance Minister said that India’s rising global profile is due to several accomplishments like unique World Class Digital Public Infrastructure namely, Aadhaar, Co-Win and UPI; COVID-19 vaccination drive in unparalleled scale and speed; proactive role in frontier areas such as achieving the climate related goals, mission LiFE, and National Hydrogen Mission.

She said that during the Covid-19 pandemic, Government ensured that no one goes to bed hungry, with a scheme to supply free food grains to over 80 Crore persons for 28 months.

Achievements since 2014: Leaving no one behind

Sitharaman said that the government’s efforts since 2014 have ensured for all citizens a better quality of living and a life of dignity and the per capita income has more than doubled to Rs 1.97 lakh. She said that in these nine 9 years, the Indian economy has increased in size from being 10th to 5th largest in the world. Moreover, the economy has become a lot more formalized as reflected in the EPFO membership, more than doubling to 27 crore, and 7,400 crore digital payments of Rs 126 lakh crore through UPI in 2022.

The Finance Minister pointed out that the efficient implementation of many schemes, with universalisation of targeted benefits, has resulted in inclusive development and listed some of the schemes such as 11.7 crore household toilets under Swachh Bharat Mission, 9.6 crore LPG connections under Ujjawala, 220 crore Covid vaccinations of 102 crore persons, 47.8 crore PM Jan Dhan Bank Accounts, Insurance cover for 44.6 crore persons under PM Suraksha Bima and PM Jeevan Jyoti Yojana, and Cash transfer of Rs 2.2 lakh crore to over 11.4 crore farmers under PM Kisan Samman Nidhi.

Priorities

Sitharaman listed seven priorities of the Union Budget and said that they complement each other and act as the ‘Saptarishi’ guiding us through the Amrit Kaal. They are as follows: 1) Inclusive Development 2) Reaching the Last Mile 3) Infrastructure and Investment 4) Unleashing the Potential 5) Green Growth 6) Youth Power 7) Financial Sector

Priority 1: Inclusive Development

The Government’s philosophy of Sabka Saath Sabka Vikas has facilitated inclusive development covering in specific, farmers, women, youth, OBCs, Scheduled Castes, Scheduled Tribes, divyangjan and economically weaker sections, and overall priority for the underprivileged (vanchiton ko variyata). There has also been a sustained focus on Jammu & Kashmir, Ladakh and the North-East. This Budget builds on those efforts.

Health, Education and Skilling

Medical & Nursing Colleges

The Finance Minister announced that one hundred and fifty-seven new nursing colleges will be established in co-location with the existing 157 medical colleges established since 2014. She also informed that a Mission to eliminate Sickle Cell Anaemia by 2047 will be launched, which will entail awareness creation, universal screening of 7 crore people in the age group of 0-40 years in affected tribal areas, and counseling through collaborative efforts of central ministries and state governments.

Teacher Training

Sitharaman said that Teachers’ training will be re-envisioned through innovative pedagogy, curriculum transaction, continuous professional development, dipstick surveys, and ICT implementation. She added that the District Institutes of Education and Training will be developed as vibrant institutes of excellence for this purpose.

Reaching the Last Mile

The Finance Minister said that Prime Minister Vajpayee’s government had formed the Ministry of Tribal Affairs and the Department of Development of North-Eastern Region to provide a sharper focus to the objective of ‘reaching the last mile’. She said that Modi Government has formed the ministries of AYUSH, Fisheries, Animal Husbandry and Dairying, Skill Development, Jal Shakti and Cooperation.

Infrastructure & Investment

Sitharaman said, investments in Infrastructure and productive capacity have a large multiplier impact on growth and employment and in view of this capital investment outlay is being increased steeply for the third year in a row by 33 per cent to Rs 10 lakh crore, which would be 3.3 per cent of GDP. She said that this will be almost three times the outlay in 2019-20. The ‘Effective Capital Expenditure’ of the Centre is budgeted at Rs 13.7 lakh crore, which will be 4.5 per cent of GDP.

Unleashing the Potential

The Finance Minister said that for enhancing ease of doing business, more than 39,000 compliances have been reduced and more than 3,400 legal provisions have been decriminalized. She added that for furthering the trustbased governance, Government has introduced the Jan Vishwas Bill to amend 42 Central Acts.

Sitharaman said that Prime Minister has given a vision for “LiFE”, or Lifestyle for Environment, to spur a movement of environmentally conscious lifestyle. India is moving forward firmly for the ‘panchamrit’ and net-zero carbon emission by 2070 to usher in green industrial and economic transition.

Youth Power

The Finance Minister said that to empower the youth and help the ‘Amrit Peedhi’ realize their dreams, Government has formulated the National Education Policy, focused on skilling, adopted economic policies that facilitate job creation at scale, and have supported business opportunities.

She also announced that Pradhan Mantri Kaushal Vikas Yojana 4.0 will be launched to skill lakhs of youth within the next three years. On-job training, industry partnership, and alignment of courses with needs of industry will be emphasized. The scheme will also cover new age courses for Industry 4.0 like coding, AI, robotics, mechatronics, IOT, 3D printing, drones, and soft skills.

Unity Mall

The FM said that States will be encouraged to set up a Unity Mall in their state capital or most prominent tourism centre or the financial capital for promotion and sale of their own ODOPs (one district, one product), GI products and other handicraft products, and for providing space for such products of all other States.

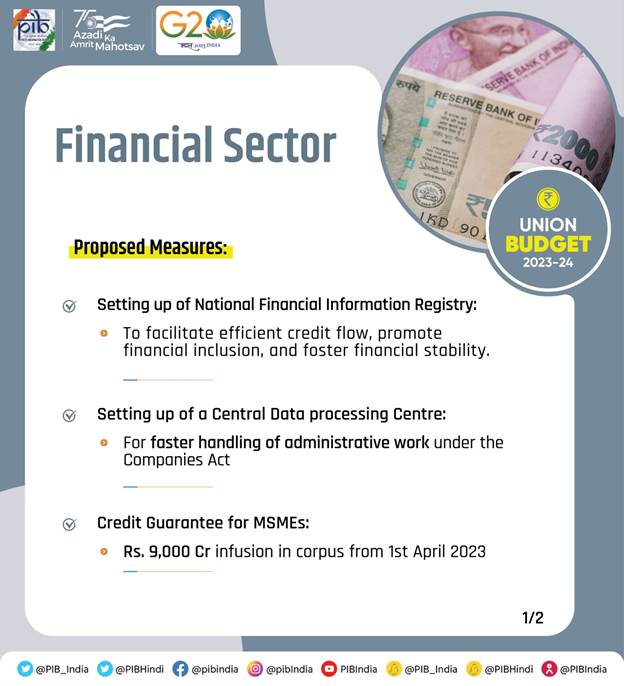

Credit Guarantee for MSMEs

The Finance Minster said that last year, she proposed revamping of the credit guarantee scheme for MSMEs and announced happily that the revamped scheme will take effect from 1st April 2023 through infusion of Rs 9,000 crore in the corpus. This will enable additional collateral-free guaranteed credit of Rs 2 lakh crore. Further, the cost of the credit will be reduced by about 1 per cent.

Smt. Sitharaman said that a National Financial Information Registry will be set up to serve as the central repository of financial and ancillary information. This will facilitate efficient flow of credit, promote financial inclusion, and foster financial stability. A new legislative framework will govern this credit public infrastructure, and it will be designed in consultation with the RBI.

She also announced that a Central Processing Centre will be setup for faster response to companies through centralized handling of various forms filed with field offices under the Companies Act.

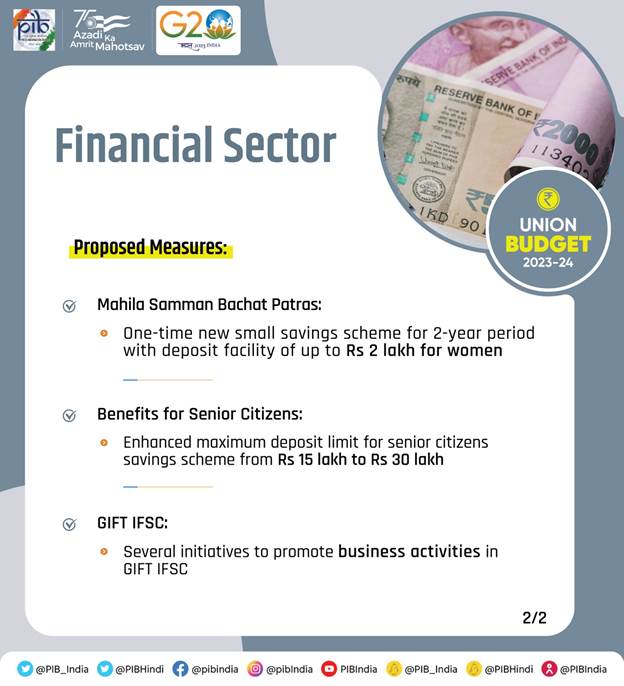

For commemorating Azadi Ka Amrit Mahotsav, a one-time new small savings scheme, Mahila Samman Savings Certificate, will be made available for a two-year period up to March 2025. This will offer deposit facility upto Rs 2 lakh in the name of women or girls for a tenor of 2 years at fixed interest rate of 7.5 per cent with partial withdrawal option.

Budget Estimates 2023-24

Concluding the Part-One of the General Budget, Ms Nirmala Sitharaman said that the total receipts other than borrowings and the total expenditure are estimated at Rs 27.2 lakh crore and Rs 45 lakh crore respectively. The net tax receipts are estimated at Rs 23.3 lakh crore.

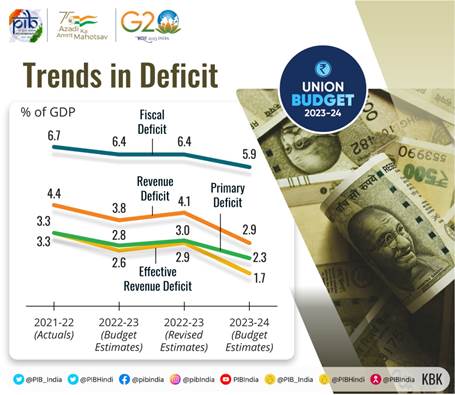

The fiscal deficit is estimated to be 5.9 per cent of GDP.

Sitharaman provides major relief in the personal income tax. The indirect tax proposals contained in the budget aim to promote exports enhance domestic value addition, encourage green energy and mobility.

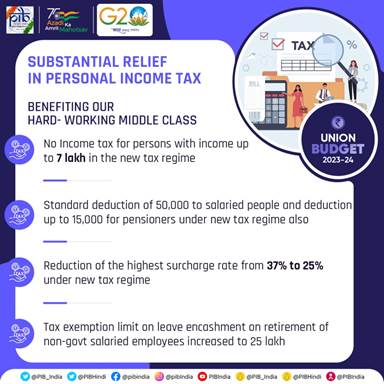

Personal Income Tax

There are five major announcements relating to the personal income tax. The rebate limit in the new tax regime has been increased to ₹ 7 lakh, meaning that peons in the new tax regime with income upto ₹ 7 lakh will not have to pay any tax. The tax structure in the new personal tax regime has been changed by reducing number of slabs to five and increasing the tax exemption limit to ₹ 3 lakh. This will provide major relief to all tax payers in the new regime.

The benefit of standard deduction has been extended to the salaried class and the pensioners including family pensioner under the new tax regime. Salaried individual will get standard deduction of ₹ 50,000 and pensioner ₹ 15,000 as per the proposal. Each salaried person with an income of ₹ 15.5 lakh or more will thus gain ₹ 52,500, from the above proposals.

The highest surcharge rate in personal income tax has been reduced from 37% to 25% in the new tax regime for income above ₹2 crore. This would result in maximum tax rate of personal income tax come down to 39% which was earlier 42.74%.

Indirect Tax Proposals

The indirect tax proposals announced in the budget by the Union Minister for Finance & Corporate Affairs, Smt Nirmala Sitharaman emphasized on simplification of tax structure with fewer tax rates so as to help in reducing compliance burden and improving tax administration. The number of basic customs duty rates on goods, other than textiles and agriculture, has been reduced from 21 to 13. There are minor changes in the basic customs duties, cesses and surcharges on items including toys, bicycles, automobiles and naphtha.

To avoid cascading of taxes on blended compressed natural gas, excise duty on GST-paid compressed bio-gas contained in it has been exempted from excise duty. Customs duty exemption has been extended to import of capital goods and machinery required for manufacture of lithium-ion cells for batteries used in electric vehicles.

To further deepen domestic value addition in manufacture of mobile phones, the Finance Minister announced relief in customs duty on import of certain parts and inputs like camera lens. The concessional duty on lithium-ion cells for batteries will continue for another year. Basic customs duty on parts of open cells of TV panels has been reduced to 2.5%. The Budget also proposes changes in the basic customs duty to rectify inversion of duty structure and encourage manufacturing of electrical kitchen chimneys.

- Info based on PIB Release

/tice-news-prod/media/agency_attachments/EPJ25TmWqnDXQon5S3Mc.png)

Follow Us

Follow Us